Investing Series: Investing in ETFs / ETPs in Australia or New Zealand

Giving some investing series link love to my friends Down Under in Australia and New Zealand.

I write more for North America but for people wanting to learn how to invest, I figured I might as well give a sample portfolio.

ETP = Exchange Traded Products, which holds ETFS which are Exchange Traded Funds

LIST OF ETFs SORTED BY MER

I chose to look only at iShares and Vanguard because those are usually the two with the lowest MERs.

LIST OF RECOMMENDED ETFs

I went through the list quickly and found a diverse range of ETFs I’d purchase for myself if I lived there.

These are the ones who are interesting because the MER is low and reasonable. The only caveat is that some of the ETFs are not held in AUD, they’re in USD, so you would have to take AUD, convert it to USD and then buy the ETFs on the stock exchange.

I highlighted them in green:

SAMPLE PORTFOLIO

This is what I would personally pick based on my age (30s), and my level of risk. I’ll explain my choices below.

U.S. Market

I chose VTS or IVV for the U.S. market because it has the lowest MERs and they do the job decently.

I put it at 25% because the U.S. is a big chunk of the world market, compared to Australia representing only 3%.

It’s always better to invest in your country, but even in Canada, I don’t put as much into Canada as I do in the U.S.

25% is a good starting percentage, you might even want to increase it but it’s up to you to decide if you want to go more conservative / local (Australian shares or Australian bonds), or more risky (emerging markets).

Australian Market

I chose VAS for this. Lowest MER, and it covers the average index of Australian shares. Not much else to say here.

15% is a good chunk, you might even want to increase this and lower the percentage allocated to emerging markets below, but that’s up to you.

All World excluding the U.S.

Now this fund covers a wide range of the world, MINUS anything in the U.S., which you have already covered at 25%. I put 25% in here too, because it’s like investing in the rest of the world.

Bonds

I chose VAF and VGB for this solely because of their lower MER.

I put it at 10% (low) because I am young and I can weather the storm. You should always hold a few bonds in your index fund portfolio, and 10% is my minimum.

Other

I put 25% here because I am riskier, and I like taking more risks when I am younger.

Now, EAFE stands for Europe, Australasia and the Far East, so you may already have this covered with your portfolio in Australia, and you might want to put more money in the Global 100 (top 100 companies in the world), or Emerging Markets (BRIC nations = Brazil, Russia, India, China).

OR, you can just scrap this 25% section all together and strengthen your position in the U.S., Australia, and All World Excluding the U.S.

It depends on how risky you want to go.

INVESTING FOR NEW ZEALANDERS

New Zealand is so small that you can’t really find any major brokerage like Vanguard offering NZ-specific ETFs.

You basically have to have an account in AUD and end up paying taxes (obviously) on your investments held in AUD.

That said, I managed to find a brokerage that handles New Zealand, and it is the ONLY ONE that does New Zealand.

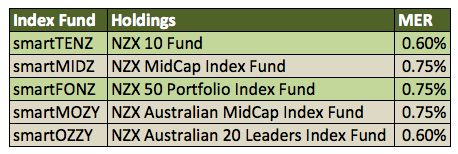

Their ETFs are concentrated in NZ, and are bit telecommunications-heavy, but I’ll go into a sample NZ portfolio later.

Here’s what SmartShares offers and the two I like that are highlighted:

So based on what is offered here, you’d have to open an account with SmartShares, invest about 15% – 20% of your money there into these two funds (depending on if you want to diversify between 10 or 50 companies in New Zealand), and then invest the rest of your money buying ETFs from Vanguard or iShares in either AUD or USD.

Unfortunately, to invest as a NZ’er you need to invest in Australia.

Here’s what I’d create as a sample portfolio:

Same rules apply as above, except I added NZX 10 and 50 as 15% of your portfolio, and reduced the holdings in the emerging markets and in Australia.

I’d consider that any investment in Australia (10% in this case) is just as good as investing in your own country, so with that in mind, you have about 25% in Australia and New Zealand as part of your portfolio.

WHAT BROKERAGES TO USE

I am not familiar with brokerages there, but I can guarantee they will not be cheap.

The good news is that you will be investing in index funds, re-balancing perhaps 3 – 4 times a year or less, which means you pay that $30 fee per trade, but you may have to just buy more of one fund and not buy another to rebalance, which will save you $30.

The less funds you buy, the more money you save. Let’s put it that way.

Australia: I found a list of “The best brokerages in Australia”, and I’d also take a look at e*Trade if I were you.

New Zealand: ANZ Securities, which deals in NZ. Otherwise, you may have to go with an Australian brokerage because nothing seems to exist for NZ (man you guys get screwed)

Now that you have the basic info for your area, all the rest of my investing series posts still apply, you just need to mentally substitute American / Canadian funds for your Australian / New Zealand ones.

Here are some posts:

- What kind of investor are you?

- What does re-balancing a portfolio mean?

- How should most people invest their money?

- How do you get money to get started in investing?

- What is an “MER” or Management Expense Ratio?

- What is a mutual fund?

- What is the difference between a mutual fund and an exchange-traded fund?

- How to invest in index funds

- How do I set up an index fund portfolio?

- What is an “MER” or Management Expense Ratio?

- How to look for and choose an index fund to invest in

6 Comments

-

-

SarahN

Thank you! I’m with e*trade, which interestingly is run by the same ‘company’ that you recommend about for NZ. I suppose Vanguard is a ‘brand’ I don’t know, and when I read further, I understood what you meant. You’re not wrong, each trade is pricey!

-

NZ Muse

Thanks missy! Not ready yet to branch out to ETFs but maybe there’ll be more options by then.

Darren Turnbull

If your wishing to invest within Australia I can recommend Selfwealth & or Pearler