Investing Series: Index Funds – Comparing TD E-Series to iShares to Vanguard in Canada

This is a part of the Investing Series.

————————————————-

VANGUARD IS NOW IN CANADA!

So I’m pretty excited to tell you that Vanguard is NOW IN CANADA!

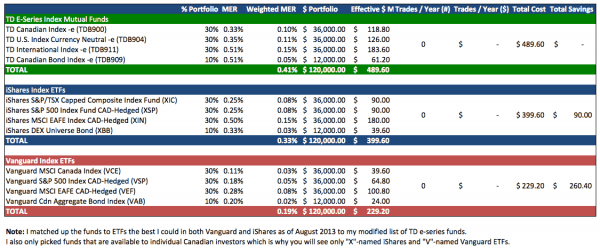

Not only that, their Management Expense Ratios (MERs) for their ETFs are at about half of TD E-Series Index Mutual Funds, and significantly lower than iShares ETFs.

COMPARISON BETWEEN TD E-SERIES, ISHARES AND VANGUARD FOR INDEX FUND INVESTING IN CANADA

(In case you’re wondering, a mutual fund is the same as an ETF, the only difference is in the way it’s bought, priced, and sold. More on that topic is available in my Investing Series.)

You can click to make it larger:

Note: The chart is valid as of August 1st 2013 and no later than August 1st 2013. (Many thanks to reader Dave for pointing out that my chart was inaccurate and gently nagging me to do the right thing and fix it 😉 )

I had to switch around a few TD E-Series funds as noted in the chart from my earlier version I created in March 2013, so I could better match up the iShares and Vanguard ETFs as much as possible.

Otherwise, I myself, normally buy e-series funds in US$ as much as possible because I have more future faith in the U.S. dollar than the Canadian one, but alas, iShares and Vanguard do not offer such US$ options.

If you would like to verify to see if more iShares or Vanguard ETFs have been added that might appropriately match TD e-series funds closer past August 1st 2013, here are the 3 links I used:

Buying ETFs on Questrade is now commission-free. You will only pay commissions on selling them. Other fees not related to commissions, still apply in buying or selling.

(Scroll down further to read more about buying ETFs commission-free.)

Now the savings with Vanguard at $260 a year and some change may not seem like a big deal to you, but over the course of 30 years, and with a portfolio that will only continue to grow in size, the savings will be enough to want to make a change today, when it doesn’t cost you an arm and a leg.

I mean, why would you waste money on fees when you can just do a little work ONCE a year and save?

AT WHAT AMOUNT SAVED DOES THIS MAKE SENSE FOR ME TO SWITCH?

Before, you had to have about $120,000 saved before it became interesting or worth your while to switch over to index fund ETFs rather than an index mutual fund at a bank.

Now, you only need about $60,000 before it becomes interesting.

At $60,000 invested in TD E-Series Mutual Index Funds, the cost is about $244.80.

This is equivalent to Vanguard Index ETFs, being rebalanced once a year (buying ETFs to make up for gaps in your portfolio, only, not selling any in this rebalancing method).

However if you wanted to sell an ETF, it would cost $9.95 each time you sell.

I TRADE ONLY ONCE A YEAR, WITH 4 INDEX FUNDS

You may be wondering why I only put 4 trades, it’s because I balance once a year. I either buy or sell once a year, but now with commission-free ETFs, I’m going to just be BUYING ETFs if I can help it.

Commission-Free Buying of ETF with Questrade starting February 1st 2013, Selling ETFs will still cost you money

It is even CHEAPER now, you can do the trades with index fund ETFs COMMISSION-FREE with Questrade.

That means that if you buy ETFs with Questrade, you won’t pay their $4.95 – $9.99 commission fee (other fees may still apply, applicable by the government).

- You’ll pay the ETF commission at the time of purchase, but we’ll rebate you in two business days

- There are no minimum number of shares you have to buy. Hold them for as long as you’d like

- Buying ETFs for free is only available if you’re trading on one of the Questrade IQ platforms

- ECN fees or any other incidentals charged by the markets are your responsibility

- Your standard commissions will apply when you sell an ETF

So basically, if you sell your ETFs, you WILL pay a fee or if there are ECN fees and so on, but you can use your $50 in free Trades because of my referral ID.

However, you can avoid fees altogether, if you buy ETFs every 3 months (or once a year), and rebalance your portfolio at the same time.

Something along this strategy:

- Put money into the ETFs you want in March (pay no commissions)

- Check your portfolio in June to see where you need to rebalance

- Put more money into ETFs to rebalance out the portfolio without selling any ETFs

- Check your portfolio in September to see where you need to rebalance

- Put more money into ETFs to rebalance the portfolio without selling any ETFs

- Check your portfolio in December to see where you need to rebalance

- Put more money into ETFs to rebalance the portfolio without selling any ETFs

- Wash..rinse..repeat

Or, just do all of this rebalancing and buying (not selling, if you can help it) ONCE, at the end of the year (December).

You can basically not pay $20 – $40 a year, which is easy pickings, and adds up over time.

It’s also a great way to direct your paycheque towards investing and buying ETFs on a regular basis, especially if it’s commission-free with purchases at Questrade AND you pay lower MERs.

WHERE CAN I GET $9.95 PER TRADE AT A DISCOUNT BROKERAGE?

Questrade is where I’m at if you haven’t noticed.

I think they’re awesome, and have thought they were great since I started investing.

If you use my referral ID with Questrade, you can get up to $50 in free trades.

You can enter this code o0soehds when you open your new account.

After pressing “Enter”, it should immediately display what the deal is ($50 in free trades!!).

You can also hold RRSP and TFSA accounts in Questrade as well, and trade stocks or more ETFs in them. I personally use my TFSA contribution room for stocks.

The minimum is $4.95 a trade up to $9.95 as a maximum.

After the $4.95 charge, it is $0.01 (a penny) a stock as a fee.

So between $4.95 to $9.95, you can buy about 500-ish stocks (at a penny each), before the $9.95 charge always applies and it becomes the standard charge.

Oh, and I get $70 in cash if you do decide to go with them (don’t ask, I didn’t make up the rules.)

IF YOU GO WITH TD WATERHOUSE HERE ARE THEIR PRICES:

I emailed and got this:

Investors executing more than 150 trades per quarter will pay a flat rate of only $7.00 per Canadian or US equity trade.

Investors executing 30 – 149 trades per quarter will pay a flat rate of only $9.99 per Canadian or US equity trade.

No matter how often you trade.

Clients with household assets of $50,000 or more with TD Waterhouse Discount Brokerage will pay a flat rate of $9.99 per Canadian or US equity trade. You must also sign up for eServices to qualify for this rate.

Trades for Canadian or US Options will be subject to the same flat rates plus $1.25 per contract.

It’s pretty expensive to pay about $7 – $9.99 PER trade, flat, not even depending on the number of shares you buy.

IT IS CHEAPER TO GO WITH VANGUARD AT THIS POINT, ESPECIALLY WITH QUESTRADE’S NO-COMMISSION ETFs

I mean if you just look at the near-$500 it costs to stay at TD e-series, it is cheaper to buy Vanguard Index ETFs by a long shot and it all adds up.

It’s like paying bank fees for nothing, I’d basically be burning my money out of sheer laziness.

They haven’t added all the funds in either, so the list is pretty slim right now, but I have total faith they’ll create something as robust as iShares, or as their U.S. ETFs.

A NOTE ON U.S.-BASED ETFS THAT PAY DIVIDENDS

Please note that if you do invest in U.S.-based ETFs and receive dividends, you WILL be indirectly taxed 15% on any dividend gains, that is, they take out the money in the U.S. for dividend taxes before you get them in your portfolio in Canada.

The only place where you won’t get the 15% dividend tax is if you hold index ETFs in your Registered Retirement Savings Plan (RRSP) because it is recognized by the tax treaty between U.S. and Canada as being a tax-sheltered account, in which case, you can simply apply for a dividend tax refund when you do your taxes.

For Americans, Canada only recognizes 401Ks as a tax-sheltered account.

Finally, Tax-Free Savings Accounts (TFSAs) are not under this tax treaty, and if we were in the U.S., the Roth IRAs would not be under this Canada-U.S.A. tax treaty either.

5 Comments

-

Jane Savers

One of the reasons I left my old bank CIBC was because I did not qualify for the cash back Visa because my income was too small.

I bank at TD Canada Trust and use their online brokerage and was not aware that I am being discriminated against because my household assets are low. I have to pay higher fees to get the same service as a person with more assets.

Time for a firm yet polite email to my TD online broker. Or, time to change online brokers.

-

Mochi & Macarons

Yes you should definitely email them, but frankly, you should think about changing online broker when your assets are low enough.

Right now, with the surge in the markets, I’m torn between quitting TD bank and moving everything I have to Questrade (and eating the capital tax of 50% on my gains), or leaving them there.

I think the longer I leave them, the worse it will get in terms of fees. I might as well bite the bullet and do it now so I am positioned for the future.

Hard to say. I’m waffling right now. 50% taxes on capital gains is no joke.

-

-

Liquid_Independence

Vanguard certainly seems like the clear winner if you have a lot of funds 😀 I should do more indexing, but I have a habit of buying individual stocks >_< I'm with TD now. So I might think about switching over to Questrade now because of their commission free ETF trades.

-

Mochi & Macarons

Vanguard is pretty amazing, especially after having had a taste of it in the States.

I like individual stocks too (dividends), but indexing is the just the easiest way to make sure the bulk of your wealth grows without thinking about entry points.

-

Asset-Grinder

Great blog. Looking forward to your future posts!

Good Day and Grind On!