Credit Cards: How I’ve never paid a cent in interest, and check for fraud at the same time

Credit cards are fraught with dangers — either you feel invincible like you can over spend, or someone steals your card number and spends like a rockstar under your name!

Either way, they are miniature plastic devils unless you use them wisely.

I have never paid a red cent in interest on a credit card in my life, and at the same time, I’m able to check for any fraud, like unexplainable charges or strange bill names.

Why you shouldn’t pay interest on a credit card

If your credit card is anything like mine at 19% interest, you DON’T want to be paying 19% extra on anything you buy, so paying off those high-interest cards, is in your interest.

Of course, if you are in debt, do your best, and pay off your highest interest rate cards first.

Why you should always carefully check your credit card statements

There are plenty of scammers out there.

Some will get a hold of your card number, and charge a small amount like $2.50 from a store to check to see if you notice that you didn’t make that purchase.

If all goes well for the next 2-3 months, they know they can make regular purchases on the card, running up the tab and no one would be the wiser.

What saves you in this case, is if you check your statements very carefully, and if you have a credit card company that is always on the lookout for where the charges are coming from (sometimes the country is a tip off, especially if you don’t even live there!)

Other scams include just charging a large amount of money and dumping the card. Unfortunately, if you don’t check your statement and you aren’t careful about your spending, you may actually think that YOU spent that money!

Luckily, if you call within a reasonable amount of time (2-3 months), a credit card company can write it off as fraud and issue you a new card. Otherwise, you’re the one that’ll be paying for that crook’s spending spree.

The $0 Method of Credit Card Repayment

I use a method I like to call The $0 Method, but I don’t know if anyone else in the PF world does the same thing. It’s a bit time consuming (you have to keep up on it), but it’s absolutely worth it.

My rule is: Use your credit card like a debit card — every time you use your credit card, pay the exact amount immediately.

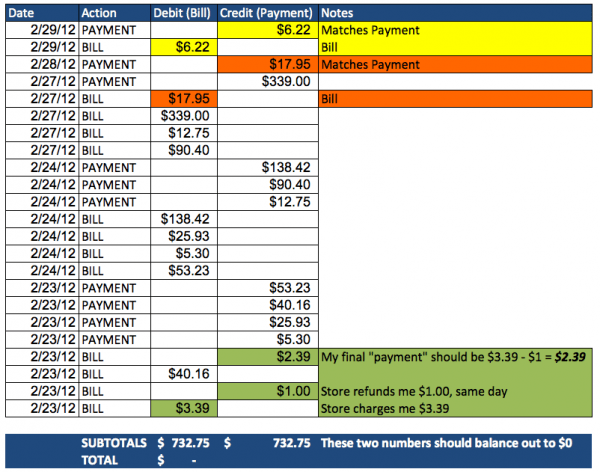

This is what my typical credit card statement might look like at any given time:

I match each bill to each payment I made online (I do all my banking online), and this is what it looks like at the end, including instances where I may have a refund from a store:

Why this method is great

- If your statement comes out to more than $0, you may have missed a payment somewhere

- You will be checking for fraud as you check the amounts you paid to match them

- You will know what balance you have on the card (e.g. credits to use to other purchases)

- Everything is easy to match and see (sometimes I invert the numbers & pay too much or too little)

- If the credit card company makes a mistake, you have a traceable record (it has happened to me!)

Only drawback: It is time consuming and I lose “interest” on my money.

I could certainly just leave the money in my account and let it accrue interest instead of putting it straight on a card, but I prefer being OCD about it.

I lose about $3.37 a month from being OCD and squared up on my bills, and sometimes I flip flop between letting my money linger in a high-interest savings account until the very last minute, to just paying everything at once.

When I get my statement and I see more than $0 (or just for fun), I will check every transaction and payment to make sure it all matches.

The good news, is that if you see a statement for $0, you don’t have to bother checking it, because you know it’s been paid correctly, and there’s no chance for fraud (they wouldn’t really know that you’d be so OCD about each payment).

There have been rare moments when I missed a whole bill payment because my brain went stupid and thought I already clicked on Bill Payment.

As for the credit card company making a mistake, I caught them twice in my life, forgetting to put the correct CREDIT (Payment) onto my card, and it looked like I was carrying a balance. Grr.

Otherwise, stick to using cash or debit

I get grocery points on my credit card, and can only use a credit card to book hotels or flights, so it’s a necessity for me.

Otherwise, I’d use cash.

How do you handle your credit card tracking?

6 Comments

-

-

Jessica

I don’t know if this is completely true, because I don’t really care about chasing credit scores so I don’t pay attention to what mysterious factors they use to calculate them. I have heard though that if your statements consistently come through at $0, it appears as though you are not using your credit card at all to the Credit Rating people, and you’ll get dinged for low utilization. They only see what your statement reports, not any of the fine details. If it looks like you aren’t using your card, then I guess you aren’t proving to them that you can use credit responsibly? There’s a ton of crap online about what the “ideal” percentage of utilization you should show is. But, you only need a good credit rating if you need credit, so…

I do a weekly reconciliation by logging in and verifying everything, but I don’t do payments mid-statement. I have payments set up to automatically withdraw, and that also gets reconciled with my bank account, so I feel like my bases are covered.

Having said that I’ve never caught any errors myself – it’s always the credit card company calling me to notify me of things that they caught before they even showed up, or to verify purchases that were flagged as suspicious. Fraud is becoming very common but in my experience the card company’s fraud department is crazy on top of it.

-

Sense

Pretty normal, I’d say–at the end of each month I look at all of my credit card statements and bank charges and check to make sure they all match up to items entered into my monthly budget (every time I spend $$, I make a note of it in my Excel budget spreadsheet). (I actually check my credit card online accounts about once every week, but I am more thorough at the end of the month when I schedule payments, transfer NZD to USD, etc.)

Recently someone used my NZ credit card for over $700 worth of Uber trips in the UK over 3 days. Immediately upon opening my credit card online account page, I knew something was wrong–the balance was WAY TOO HIGH. It apparently takes the cc company (ANZ bank, a VISA card) about a month to investigate and (hopefully) take the charges off of my account/refund my $$, but I caught the charges within 3 days or less, which is pretty dang good.

CC fraud is getting way more common–I normally keep the same card until the expiration date, but I’ve had to replace nearly every card I use for travel bookings/during trips over the past ~5 years. Scammers seem to be mainly based in other countries (when I traveled to Brazil I had to replace the SAME DANG card once before my trip and once after!). Cards I exclusively use within NZ or within the US are usually pretty safe, and many of the US premium card companies (Chase) are excellent at catching fraud almost immediately.

Dane

My rule #1: pay off the exact due a day or two after the statement is issued.

Rule #2: Treat it as your debit card. Buy only you need and within your monthl budget.