Why I invest in dividends as an investing strategy

Dividend-paying stocks are definitely not a passive investing strategy. You need to research into each stock, monitor the portfolio, keep on top of the news and trim where needed.

My investing strategy is like a buffet – just a little bit of everything

I have an investing strategy of 50% mutual funds and 50% dividend-paying stocks.

I haven’t really come across this mix because most people seem to be in one of these categories:

- 100% Index Mutual Funds

- 100% Dividend Stocks

- 100% Real Estate

I chose a mix between 1 & 2 because I like to cover my bases, and avoid physical real estate completely.

Why? I HATE PEOPLE. That’s why. The thought of having to constantly be “on call” even when on vacation, because a water heater might break and need to be replaced ASAP, fills my spine with dread.

I don’t want to interview, talk to, or manage anyone.

This is why I am not a manager in any sense of the word. I can lead people on a team, but if you don’t perform, you’re out. As a manager, you can’t do that. You have to try and nurture all of this talent and coax them to work together – this is not my thing.

So, I invest in REITs (Real Estate Income Trusts) instead.

I do have a fourth investing strategy that rarely (if ever, I haven’t see it yet to be honest) shows up on anyone’s radar and that is private lending.

While my mutual funds and dividend-paying stock portfolios are being fully funded with mini goals ($500,000 in mutual funds, $12,000 – $50,000 a year in dividend income), I am slowly trickling $1000 at a time into my private lending platform, to a maximum of $100,000 fully committed to others and reinvested back into the portfolio.

Why dividend investing is not for some people and that’s cool….

Dividend-paying stocks for some people are ridiculous because of these general reasons:

- Warren Buffett, the Oracle of Omaha and Guru of Investing says most people should just stick their money into index funds – He isn’t wrong here, I concur, frankly.

- Berkshire Hathaway, his company’s stock, doesn’t pay dividends so ….. that’s why dividends are not a great strategy because WB said so – This is pretty weak as an argument.

- You’re investing in ONE company and putting all your money into it, instead of diversifying with a fund – Not wrong here either, but that doesn’t mean it’s the only way to invest

Those are the main arguments I see all the time against dividend investing.

What works for someone, may not work for someone else, and again, I am into the “pick a little of everything” philosophy, so I am in both mindsets.

What I don’t really see is why no one talks about WHY it might be an interesting investment approach, only that it ISN’T.

That doesn’t seem very fair to me. Quite one-sided, actually.

So this is why dividend investing is interesting for me

1. “Dividends don’t lie” (Geraldine Weiss)

I KNOW you are all imagining Shakira’s song “Hips don’t lie” right now, don’t kid yourself.

It’s simple – if you don’t have money, you can’t give what you don’t have.

Companies need actual cash on hand to pay out to it shareholders for dividends or else… they can’t declare them.

There has been (and always will be) companies cooking the books to pump up their stock – Bre-X (1995), Enron (2001), Bernie Madoff (2008), and Lehman Brothers (2008) come to mind, and dividend payments are just ONE of the ways you can see whether a company is being truthful or not.

That’s not to say that companies that pay dividends are always on the up-and-up, but it is harder to fake cash payments to investors if you’re not doing well.

People who run the company, are not likely to increase dividends if the company is not doing well/cannot meet these payments.

You OBVIOUSLY have to pick GOOD dividend companies, not ones that are just trying to pay one to attract investors.

What’s the point of having $10,000 in a stock paying a 10% dividend if it is worth $1000 a year later?

My goal is to have both – capital gain AND a side income in dividends.

2. Dividend income is real, tangible income

It is real money in your pocket if you want.

I always count dividend income as REAL MONEY because it is money I would not have gotten otherwise, had I not owned that stock.

Even the 1.2% dividend payout I get from my mutual funds, is counted as REAL MONEY.

I just happen to reinvest that REAL INCOME (just like an income stream from a rental if I didn’t hate people so much), back into buying more of the stock.

It isn’t “fake money” – you could keep your shares as-is, stop reinvesting the dividends and take it to spend.

3. Dividends pay you…

I imagine what I put into dividend stocks, as the tree. This massive tree that is going to keep growing taller, higher, and stronger.

Then, I see dividends to be like little seedlings that pop out fully formed, and are already planted into the ground, starting to grow into trees themselves, compounding and propagating themselves until I basically have a future orchard with more seedlings all from a single tree – my initial investment.

If I started with $10,000 in a dividend paying stock that yielded 4.5%, I would see that $450 paid every year planted to buy more seedlings to grow, compounding on themselves, NOT TO MENTION the capital growth in the company itself, without having to put a single extra penny back into the stock itself.

It just keeps growing and building itself.

This is the same concept as with mutual funds, to be honest.

If you took $10,000, dropped it into a mutual fund returning 7% over time, you’d have $81,164 in 30 years.

If you did the same thing with an individual company stock, assuming it returned 7% as well, PLUS paid a dividend yield of 4.5%, you’d have $254,977.57 in 30 years.

That of course, assumes a LOT – that you find a company that returns 7% on average over that period of time, PLUS pays a 4.5% dividend.

If we drop the numbers down to let’s say a 3% return over that period of time plus pays a 1.5% dividend yield, you’d get the same number as with just dropping it into a mutual fund:

…but the key difference is you can decide to stop reinvesting the dividends and take it as an income to live on. This is the quick chart I made, with the initial $10,000 investment, assuming 3% return over 30 years with a 1.5% dividend yield:

| Year | Capital Invested | Dividends Paid & Reinvested |

| 1 | $10,000.00 | $150.00 |

| 2 | $10,454.50 | $470.45 |

| 3 | $11,252.70 | $506.37 |

| 4 | $12,111.84 | $545.03 |

| 5 | $13,036.58 | $586.65 |

| 6 | $14,031.93 | $631.44 |

| 7 | $15,103.27 | $679.65 |

| 8 | $16,256.40 | $731.54 |

| 9 | $17,497.58 | $787.39 |

| 10 | $18,833.52 | $847.51 |

| 11 | $20,271.45 | $912.22 |

| 12 | $21,819.18 | $981.86 |

| 13 | $23,485.07 | $1,056.83 |

| 14 | $25,278.16 | $1,137.52 |

| 15 | $27,208.15 | $1,224.37 |

| 16 | $29,285.49 | $1,317.85 |

| 17 | $31,521.44 | $1,418.46 |

| 18 | $33,928.10 | $1,526.76 |

| 19 | $36,518.51 | $1,643.33 |

| 20 | $39,306.70 | $1,768.80 |

| 21 | $42,307.76 | $1,903.85 |

| 22 | $45,537.96 | $2,049.21 |

| 23 | $49,014.78 | $2,205.67 |

| 24 | $52,757.06 | $2,374.07 |

| 25 | $56,785.06 | $2,555.33 |

| 26 | $61,120.60 | $2,750.43 |

| 27 | $65,787.16 | $2,960.42 |

| 28 | $70,810.01 | $3,186.45 |

| 29 | $76,216.36 | $3,429.74 |

| 30 | $82,035.47 | $3,691.60 |

You can see in year 30, you’d have $3691.60 to take as income to live on.

No need to keep putting it back into the stock, take it and spend it.

With the mutual fund, you’d have the same amount at the end, but you now have to start selling off the capital to spend that money.

4. Taxes are favourable towards eligible dividends

Obviously things may change in the future, but taxes in 🇨🇦 are pretty favourable towards eligible dividends.

Why? Because rich people take dividends.

Sorry to be so blunt but it is true.

Rich people, have influence. Influence, means they can have taxes be favourable towards the way they live – taking dividends from their investments and not drawing on the capital.

Rich people, also have businesses. These businesses are tax-shelters for their money, and they just withdraw dividends from it to live on <— this is what I do, and not only do I avoid the fees and hassle of handling payroll for myself, I save on taxes.

Side note on businesses and salaries versus dividends:

I don’t realize my income every single year, and by that, I mean I make bank, but I don’t take it all out. That’s the tax-INEFFICIENT way to do it.

If I don’t need $125,000 to live on, (and I don’t), I won’t take it out because more of that money will go to taxes and the government. Instead, I am taking out the MINIMUM I need to live on, and paying little to no taxes at all if I can.

The argument I get a lot from high-earners who have their own businesses like I do is: But what about that sweet RRSP (Registered Retirement Savings Plan) contribution room!?

Listen, sooner or later, you’ll have to withdraw that money anyway when you retire, to live on. RRSPs don’t keep growing, tax-free forever.

You have to convert it into an income producing fund like an RRIF (Registered, Retirement Income Fund), and are MANDATED to withdraw a certain percentage of it starting at age 71, by which time you’ll get taxed.

Whether I save my money in an RRSP or outside of it, leaving it in my company, invested and taking the MINIMUM amount of dividends to live on instead, is definitely the smarter, more tax-efficient way to do things.

I verified this with my accountant when I first opened my business to make sure I was doing it the best way possible, and he was surprised I was so knowledgeable about it – I just smiled and told him I liked saving money. He told me it was his recommended method, but not many people followed it because… they have needs.

I have needs too, but not that extravagant these days.

Back to our topic at hand…

You get taxed less with eligible dividends

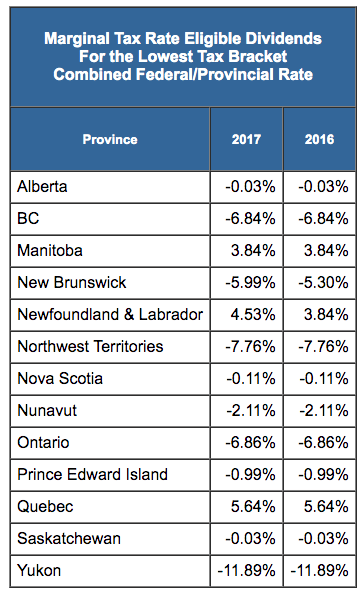

Here’s a chart from one of the best accounting websites online, TaxTips.ca.

So, let’s talk federal taxes:

The chart clearly shows what you’d get taxed at normally with a salary (Other Income Tax Rate) versus the dividend tax rates.

Some quick math reveals the savings:

| 2010 Tax Bracket | Other Income Tax Rate | Eligible Dividends Marginal Tax Rates 2012-2015 | Difference in Tax Savings |

| First $40,970 | 15% | -0.03% | 15.0300% |

| over $40,970 up to $81,941 | 22% | 9.63% | 12.3700% |

| over $81,941 up to $127,021 | 26% | 15.15% | 10.8500% |

| over $127,021 | 29% | 19.29% | 9.7100% |

Federal taxes alone, that’s pretty good.

WHOA. NEGATIVE TAX RATES!?!?!?

Hell yes.

You can literally reduce your taxes by taking eligible dividends if your income bracket is at the lowest rung. #BOOM!

Taxtips explains why, and the provincial table for the lowest income tax bracket ($40,970) is mindblowing:

Of course, I live in the province that taxes this the highest at 5.64%, but even that, is peanuts, frankly for $40,970 of income.

It means my combined tax rate if I stayed at $40,970 of dividend income IF THERE ARE NO OTHER SOURCES OF INCOME would be:

-0.03% (federal) + 5.64% = 5.63%

FIVE. POINT. SIXTY-THREE PERCENT TAXES.

This means I’d only pay $2910.71 in taxes (including $600 for healthcare) for almost $41,000 in income.

Sounds like a good deal to me.

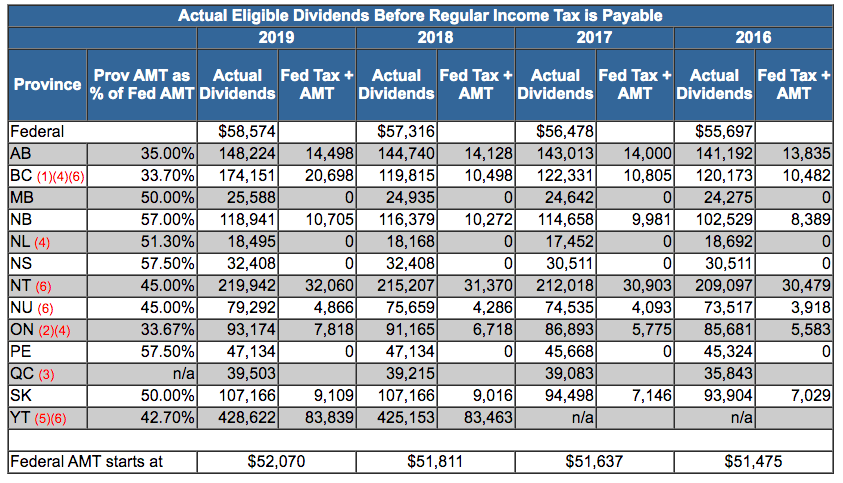

Now, let’s look at how much you can take before taxes go bananas, taking 2019 numbers:

Federal = $52,070 in dividend income before you gotta pay taxes

Provincial:

| Province | Dividend Max you can Take | Total Federal & Provincial tax you’d pay |

| AB | 148,224 | 14,498 |

| BC | 174,151 | 20,698 |

| MB | 25,588 | 0 |

| NB | 118,941 | 10,705 |

| NL | 18,495 | 0 |

| NS | 32,408 | 0 |

| NT | 219,942 | 32,060 |

| NU | 79,292 | 4,866 |

| ON | 93,174 | 7,818 |

| PE | 47,134 | 0 |

| QC | 39,503 | 0 |

| SK | 107,166 | 9,109 |

| YT | 428,622 | 83,839 |

You could, if you lived in Alberta, take $148,224 in dividends and pay only $14,498 in dividends.

In Ontario, you could take $93,174 and pay $7818

Only in Quebec (LOL), I can take $39,503 and pay $0 in taxes. That isn’t so bad, frankly.

I’d be okay with paying a little bit more if I take $50K in dividends because I am making out like a bandit on tax savings.

What about the risk of being invested in only ONE company?

Well. Don’t be so heavily invested in only one company.

My maximum for each company used to be $25,000 per. I still haven’t strayed from that, but I will only put in $25,000 in companies like banks.

For all the others that .. basically aren’t banks, but are more stable like utilities, food, things that people rely on — my maximum is $10,000.

For all other companies that deal in things like transportation, steel, etc, my maximum is $5000.

I limit my risk. I check them as thoroughly as I can, I keep on top of them, but ultimately I KNOW I could lose $5000 on those company, and I am okay with that.

As they start to get bigger, you can also trim your positions to minimize any possible losses, and find other companies to invest in.

This is definitely ACTIVE investing, not a ‘set it and forget it’, but so far, the gains for me outweigh the cons.

Also, don’t go for the juicy 6% returns unless you’re OK with losing all that money. Anything over 4% makes me squeamish, but as I have money to spare and can always just … work more … I am willing to take those risks.

Extra Reading

Thoughts?

4 Comments

-

-

nicoleandmaggie

Are there indexes for dividend stocks in Canada like there are in the US? That’s a way to diversify.

Vnss

This is honestly the BEST PF post I’ve read in such a long time and confirms why I stay reading your blog!

Even though I don’t have my own company (though now considering it–like damn!) this was such a great explanation of why owners would (and should) want to live on dividends and more generally how dividend taxation works. THANK YOU!!! It definitely reinforces my plan to have a dividend and index portfolio like you (thought not at 50/50). For me, I just love that it’s an added way to hedge your bets: slow and steady long-term indexes with great income potential, short, mid and long-term.

Please, please keep writing about your dividend/index investment strategy – I’m learning tons and loving all of it!