Lending Loop Review: Private lending in Canada side income and How to invest in alternate small business lending

Few ground rules

- Not available in Québec for the moment. Solly.

- They take a cut for making these loans available – 1.5% a year (Rates & Fees here)

- Loan terms can be a few months or a few years and you will get interest payments on that loan during that time as they pay it back over the term of the loan, but your money is LOCKED INTO THIS for that period of time.

- You can only invest up to a maximum of $10,000

- ….if you want to invest more than $10,000 (let’s say if you wanted to drop $100,000) you need to go through an Investor profile survey where they pretty much grill you on net worth, assets, debt and determine whether you make at least $75,000 – $125,000 as an annual household income to qualify, or have at least $400,000 in assets

- They already pre-screen the loans and grade them from A to D; obviously the better rated loans have LOWER interest rates (7% range), and the loans with a sketchy credit history have higher interest rates given (in the 20%) (Rates & Fees here)

HOW TO SIGN UP FOR LENDING LOOP – $25 FREE

Sign up here at Lending Loop with referral code 7B03F0 and get $25 to get started once you invest at least $1500 (I get $25 too when you do this).

WHAT IT LOOKS LIKE IN THE MARKETPLACE

You see all the loans available to fund, and you can click on each loan to read about their story:

And in each of the tabs you can click to read about their details, financials, and so on.

HOW TO INVEST

Click on the green Invest Now button on the loan if you’re interested, and then you will see it show up in your Commitments tab:

You can see the status and time left on the loan, how much you put in, the risk, the rate, and so on.

HOW TO SET UP YOUR AUTO LOANS

I only recently did this to have it auto-diversify my money for me.

You can use their system called Auto Lend where you set up parameters of which loans you will put money towards, and in what amounts.

My two plans look like this:

This means that any new loan that comes on board, I put either $25 or $50 towards it depending on the grade.

To set up Auto Lend you click on Auto-Lend in the left hand side:

Then you click on Add New Plan (obviously if you want to customize it…

And you can click on how much to commit, and for what loan grades:

Click on Enable Auto-Lend and it shows up here afterwards:

Update: I am putting more money in

I have decided to make this a $100K portfolio, so I am putting more money in, quickly.

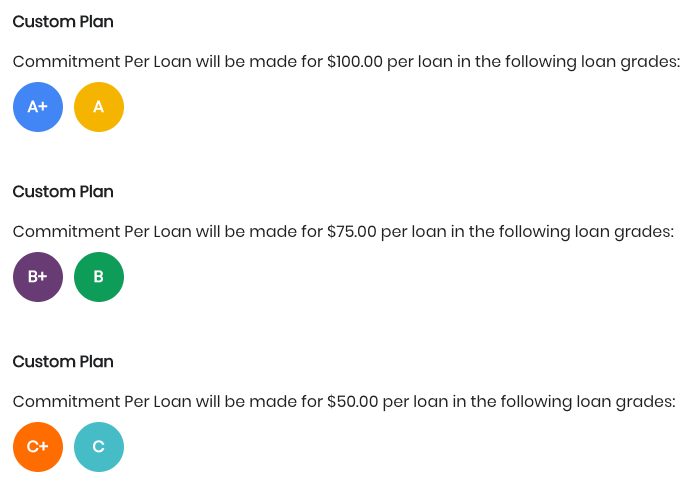

I have increased my loans to the following plan now:

- A+ and A = $100

- B+ and B = $75

- C+ and C = $50

THINGS TO REMEMBER

1. Loan Grades = Loan Risk

The higher the loan grade, the LOWER the risk and therefore the return.

If you have a return of 9% let’s say, remove the Lending Loop servicing fee of 1.5% from that, and your REAL return would be 7.5%.

(9% – 1.5% = 7.5%)

- Lenders are charged a 1.5% annual servicing fee that is collected when a business makes a repayment.

- Lenders are only charged this fee when they receive a repayment.

- The servicing fee of 1.5% is an annualized amount (1.5% / 12 months) – calculated monthly on the outstanding balance of principal at the time of the payment.

The lower the loan grade, the HIGHER the risk and HIGHER the return.

Rates & Fees here if you want to read more.

Borrowers have grades and categories as well:

2. Set up Auto Lend to Diversify Instantly

Put in small amounts – $25, $50 and let it auto-lend to loans as they hit the marketplace.

You only get an email notification of new loans if it has been on the market for more than an hour.

At that point, a loan could be completely funded within that hour and you’d miss out on it.

This is also instant diversification — various loan grades, various loans and industries all at once, with a minimum amount committed to each that you could “lose” potentially if they don’t pay you back or make their payments on time.

3. Only put in money you can afford to lock in and lose

DO NOT put your emergency savings funds in here, and DO NOT put in money you cannot afford to lock in and/or lose.

This is a RISK.

You will have that money TIED UP FOR THE NEXT FOUR YEARS or however long the loan term is.

Lending to private businesses or people is a RISK. People in general are unpredictable.

But… no pain, no gain. No risk, no $$$$$

Getting a 19% return on a D loan sounds great, but if you put in $1000 towards it, your entire amount is gone if they default. Assume the worst.

That’s why putting in SMALL amounts but in VARIOUS loans, would be the best auto-lend strategy around.

Plus you don’t have to do anything. Throw money in there, let it lend itself out.

I personally will only put in $8000 as a maximum for now. It is ~1% of my overall net worth and only 3% of my liquid assets.

As I said — I even have a couple of thousand in cryptocurrencies, so…. *shrug* You never know. This is probably more stable than cryptocurrencies, to be honest.

That is an amount I can personally afford to lose, and the bulk of my investments are in other things — assets, funds, stocks etc.

4. What you see as a yield is the GROSS .. ANNUAL yield

Example, I have 13.4% as a return:

The 13.4% gross return you see is your current annual yield, whereas the 0.9% return you calculated is a monthly yield.

As you receive interest on a monthly basis, you will continue to receive monthly returns, which will contribute towards your annual return. In a similar sense, a high-yield savings account will usually quote between 2-3% return on an annual basis whereas the monthly returns will be much lower.

Another important point to consider is the compounding effect for your returns; as you receive interest back, your funds can be reinvested, thereby recycling your initial deposit and potentially compounding the returns on your investment.

Sign up here at Lending Loop with referral code 7B03F0 and get $25 to get started once you invest at least $1500 (I get $25 too when you do this).

Any questions?

4 Comments

-

Rachel

How did you get around the not available in Quebec thing?

-

PP Gal

It’s interesting to know how it will be taxed because I’m assuming the fund is in a non-registered account. Freedom35 has a good return on Lending Loop. Maybe it’s something that will clearly stick around. I’ll be on a sideline for now.

Pingback: March 2020: The Net Worth | | Save. Spend. Splurge.