Investing Series: Where do you find all that juicy financial information on stocks?

This is a part of the Investing Series.

————————————————-

So now that we’re starting to get more into ratios and technical analyses of stocks, you might want to learn where all the shortcuts are, and for most stocks, their names are: Google Finance and Yahoo Finance.

NOTE: Incidentally, if you are interviewing for a company for your career, this is also a good place to come to to take a look at how they’re doing and what their strategy / vision is.

You can go to Google and Yahoo and pretty much find all of the technical number crunching done for you.

Here’s a quick overview of how to navigate:

NAVIGATING GOOGLE FINANCE

A misconception you might have is that you will need to know the company ticker symbol (e.g. GPS is The Gap Inc.), when in fact, Google is smart enough to know you search by names more than by ticker symbols, so you can just go to the top and type in part of a company name to get a quick search result.

Let’s try… Burt’s Bees!

You will notice that I chose Burt’s Bees, Inc, as a name to search, when in fact they are owned by The Clorox Co.

Google is so smart, they let you search by those commonly known names and then redirect you to the main company that owns them:

The quick stats about the company will be listed right at the top in Google.

You’ll know the following, and here’s a quick idea of what they all mean:

- Range: What $ range the stock has traded in recently

- 52 week: The range the stock has traded in over the past 52 weeks (or a year)

- Open: The price of the stock at open today

- Vol/Avg: How much has been traded in terms of stock (buying and selling)

- Market Cap: What does market capitalization mean?

- P/E: Price to Earnings — How to calculate price to earnings ratio

- Div/yield: How much the company pays per share / What the % yield is per share, you can read: Overview of dividend-paying stocks and How to build a dividend stock portfolio and

- EPS: Earnings per share

- Shares: How many shares have been issued

- Beta: What does beta mean?

- Inst. Own: Institutional Ownership – What percentage is held by company employees themselves

If you want to get fancy (don’t we all?) and see things like income statements, cash flow and balance sheets, go to the left-hand side and click on Financials

Depending on what you’re looking for, you will want to either look at recent Quarterly Data (every 3 months), or Annual Data (my preferred choice), and then look at their Income Statements, Balance Sheets and Cash Flows.

NAVIGATING YAHOO FINANCE

Yahoo Finance is a little (okay a LOT) uglier than Google Finance, but it is far more robust in terms of technical stats, which is why it’s still breathing.

How ugly is it?

Well it’s so ugly it hit every branch on the ugly tree on the way down to become fugly.

You pretty much need to know the exact ticker symbol to get anywhere with this beast:

Using the same test as above with Google, you can’t just type in Burt’s Bees and get redirected gently to what you’re really looking for — Clorox Co. that owns Burt’s Bees.

You have to type in CLX to get there. *rolls eyes*

Once you’re in however, it’s all gravy.

I kind of prefer the way they’ve laid out the stats more than at Google, because for instance with Div & Yield, they put it as a number and then the % in brackets so you don’t have to guess what that 3 means.

I also like that cute little graph on the right that shows how the stock is doing from close to present time.

The left-hand side bar however, is where all the gold is held:

The categories that interest me the most:

- CHARTS – All of the links here, I enjoy interactive charts.

- NEWS & INFO – Headlines is a good one to know what people are saying about the company

- COMPANY – This is where I go to the most, more on that in detail in a bit

- ANALYST COVERAGE – I kind of half ignore these people, but it’s still nice to read their thoughts

- OWNERSHIP – Ignore 99% of the time. Unless I see a red flag somewhere.

- FINANCIALS – Same as Google Finance, but Google is prettier.

YAHOO FINANCE “COMPANY” CATEGORY

I like this particular section the most.

PROFILE

If you don’t know the company and what it does, this is a good place to start.

KEY STATISTICS

I REALLY like this link. It has all the ratios done for you and you just need to plug them into your spreadsheet.

Certainly, you could run a few numbers yourself just to be sure they’re correct, but they’re fairly accurate, give or take 0.50 billion.

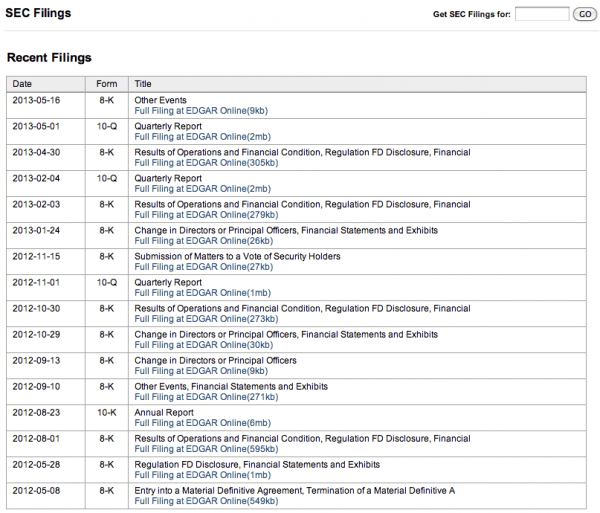

SEC FILINGS

This is a good place to get information that is otherwise not given. It’s also what is reported to the government, so sometimes it holds interesting bits of info.

For instance if you see filing for warnings to the company to get the stock up above $1.00 or else risk being de-listed by the stock exchange, it might be an interesting time to buy them (the company will power through and hustle to get up to $1.00)

COMPETITORS

Sometimes the competitors chosen make no sense, but in this case, Proctor & Gamble, and Colgate-Palmolive are pretty good benchmark rivals.

INDUSTRY

This is so that you know how their industry is doing overall, and it even shows you market caps of other companies in this industry.

COMPONENTS

They also show you what indices hold that company and how those are doing as well.

That’s about it. I use Google Finance and Yahoo Finance to glean most of my info, to weed out the company or to put it on a short list.

If you want another site to read about headlines and opinions, try Seeking Alpha.

4 Comments

-

-

Bridget

You. are. so. thorough.

I am afraid of writing at all about investing on my own blog because I think it would just be easier to link my readers here hahah

I’ve never used Google Finance (I didn’t even know that was a thing.. god I really need to get out more on the internet). I check Yahoo finance a lot. I read so much Investopedia when I was a new investor just to understand what to look for.

Great post — great series!

Debt Blag

Where? Work mostly… Which is why I’m not allowed to trade sticks :/